The wedding industry is not immune to economic and business forces

The economy is pretty good right now, so why are couples spending less on their wedding? At least per our surveys; which represent the entire economic spectrum, not just couples that purchase services from the professional side of this business. Sure, some parts of the upper end of the market are seeing spending growth, but that upper end is shrinking and while some will flourish for a while, they will eventually need to reach down into the other parts of the wedding business to maintain growth. The best example of expanded market reach in the wedding industry is the Vera Wang company.

If you have heard me speak about the 5 forces (Michael Porter on Competitive Advantage), then you’ll know that this lower spending is in direct relationship to at least 3 of the 5 forces. As a reminder, the five forces are; existing competitors, threat of new entrants, power of suppliers, power of buyers, and substitute products or services.

Except for “power of suppliers and substitute products and services” the other three forces are putting pressure on price, driving down how much couples are willing to spend. Let’s look at how each one is having an impact on todays wedding industry, plus some survey facts and economic data. Then I’d like to share with you 3 things that I think can help you take advantage of this market.

Existing Competitors

When rivalry is high, profit can be squeezed because customers will price shop. Ever just get calls about your price? The reason is that there are so many competitors and couples are simply looking for the best deal because they see the product or service as just that. And many times, just for businesses to stay working they will lower their price or they will price match etc.

I have never seen a time when there are so many locations jumping into the event space. It seems that everyone is trying to capitalize on being a wedding venue or location. Which is the trend, couples want unique and different locations to have their wedding.

Threat of New Entrants

If the cost to get into a specific space is low, then the number of competitors will increase dramatically, especially if there is a belief that money can be made easily. Think about how much it costs now to become a photographer, DJ, or wedding planner? How much less it costs to take an existing space and convert it to an event location? The simple fact that it costs less to do this is driving more people to a market worth $50+ billion annually. The wedding industry is very fragmented, most couples will use 10-12 different vendors for their wedding and there are hundreds of new businesses popping up daily in this space.

Remember when the LED light bulbs came out? They were expensive, but over time the barrier to entry became less expensive and now today you can buy a 6 pack of LED bulbs for almost the same price as original bulbs less than 10 years ago. It’s the same in all industries. As the barrier to entry is reduced, the more competitors you will have, which in turn puts pressure on the amount one can charge for a product or service.

Power of Buyers

Couples are the buyer and they are in a pretty powerful position today. They are the ones paying for most of the wedding and there are so many options for them to choose from. This makes them super price sensitive. But not just because of so many options. I believe they are also price sensitive because of other factors; like, discount bombardments and life pressures (available cash and debt). Every where you turn retailers are offering discounts. I’ve never see so many places offering discounts, its basically the norm. How many times have you went into a clothing store and not seen a discount or reconsidered buying something because you didn’t get a discount. You go to any clothing website and you get a popup, save 15% if you sign up right now… then email after email with discount codes. How can this culture not be sensitive to price now?

And if that wasn’t enough pressure, from our cost surveys almost 70% of couples said these are their highest priorities.

- 70% said; They like to shop around before making a purchase

- 69% said; Number one goal is to save as much money as possible

- 69% said; Before purchasing online, they typically read reviews submitted by others

- 67% said; Price is more important than brand

- 64% said; I like to compare prices across different sites before purchasing something online

Out of 60 different questions for buying preferences, these were the top 5 highest scored answers.

Let’s Break Down the Economics

Who’s Paying

How much do couples contribute to the cost of their own wedding? On average they contribute 72% of the total cost with the least amount contribution being 63% and the most being 85% for specific items. 53% of couples pay 100% of the cost. Interestingly, 20% of couples getting married pay less than 25% of the cost of their wedding. That is a small subset of the market where you’ll need to focus on selling the parents or relatives.

How are they paying

73% use savings, 65% use existing case on hand, after that, it falls to 36% use existing credit cards.

Income and expense

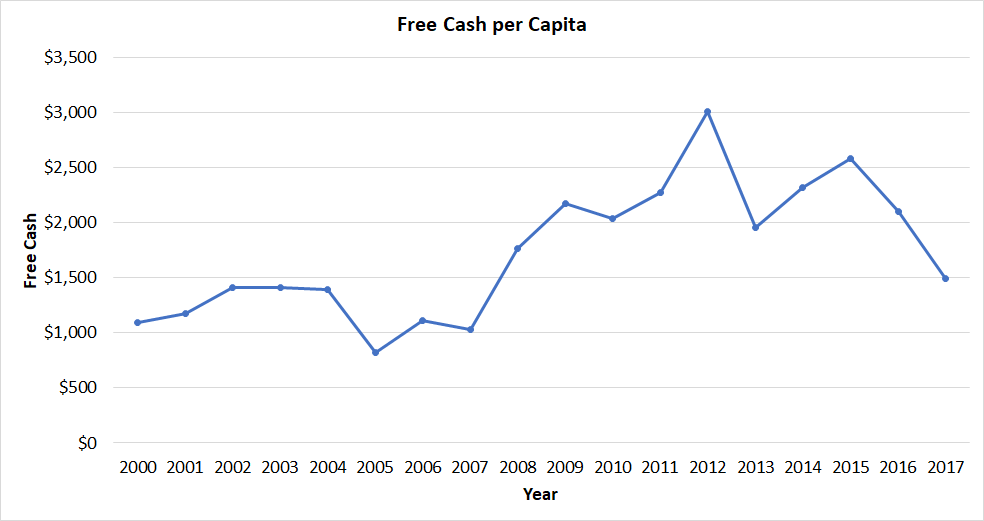

In 2017, the average household income of couples getting married was $70,200 which is only $13,700 more than the average US household income of $56,500. Income per capita in 2017 was $44,103 and expense per capita in 2017 was $42,613 leaving only $1,490 in free cash per capita. This chart shows free cash per capita since 2000. If you notice, free cash has been falling 3 straight years

Source: U.S. Bureau of Economic Analysis, “Table 2.1. Personal Income and Its Disposition,” (accessed March 1, 2018)

- Free Cash per Capita is the total income per capita minus the total expense per capita

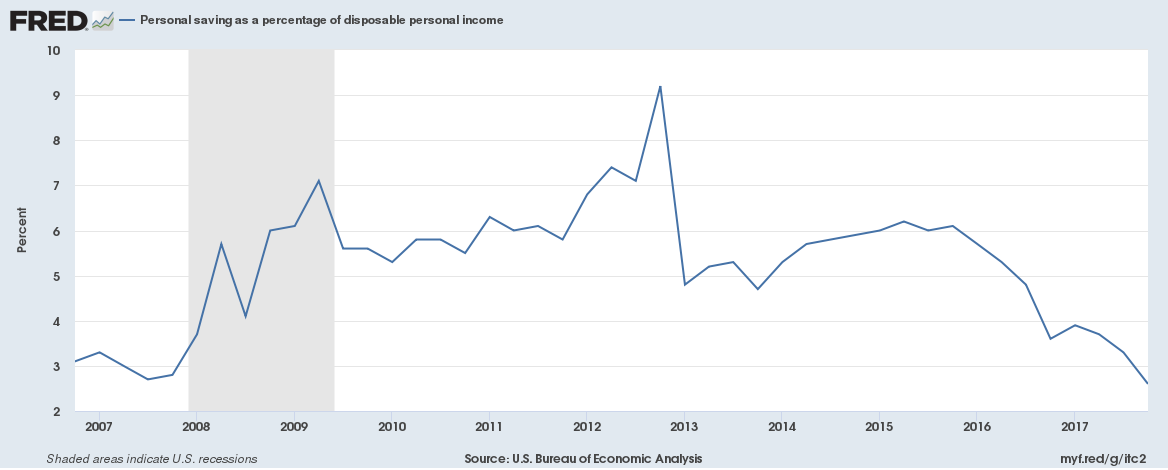

Personal savings has been falling for 2 years now and is off the high of over 9% in 2012 and is below the rate just before the economic crash of 2007/2008.

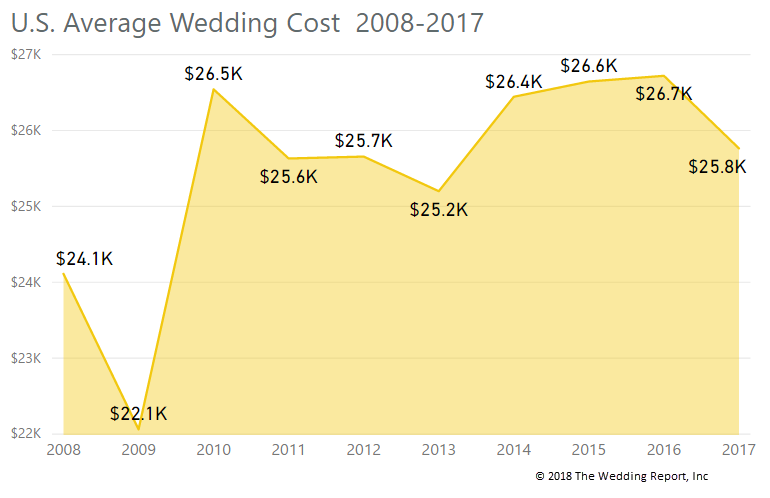

The 2 ways that couples overwhelmingly use to pay for their wedding are much lower than several years ago and this really doesn’t take into account the changes in interest for products, services, location, and type of weddings couples want. Looking at these numbers, it’s getting harder for couples to pay for the traditional, industry norm wedding. They are looking for alternatives options.

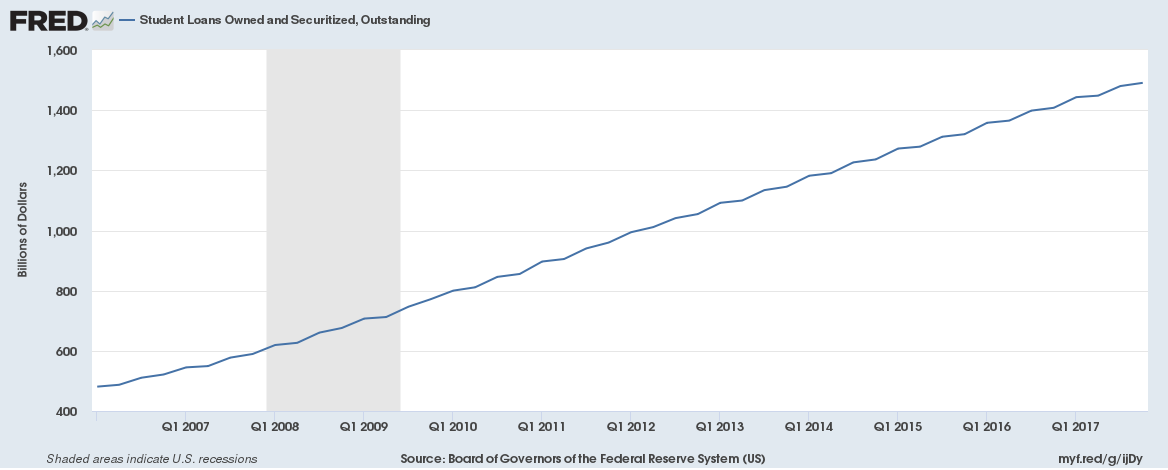

Debt

Does debt weight on the couple’s ability to pay for their wedding? Does it cause them to think about what they will buy? I say yes. A couple years ago I started asking about college debt and if it would impact how much they would spend on their wedding. In 2016 27% said, yes, they would spend less because of college debt. In 2017, it was 33%, an 18% increase in 1 year. And if that wasn’t an indicator, college debt is at an all-time high of over $1.4 trillion. That’s correct, one point four trillion dollars.

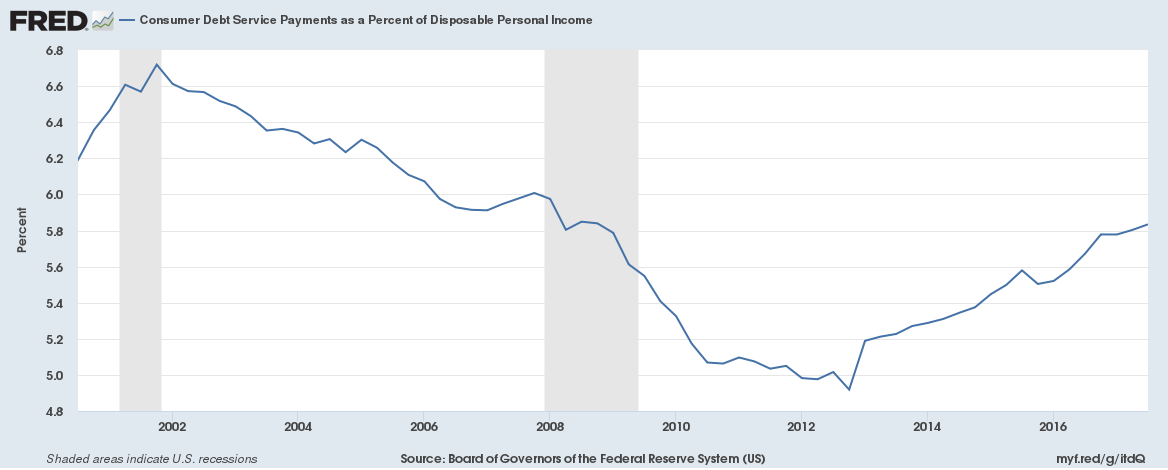

And consumer debt payments as a percent of disposable income is also back to pre-great recession levels.

At the End of the Day

Consumers are highly price sensitive right now. High levels of competition, free cash squeeze and higher debt are not helping. However, I do believe that there are at least 3 things you can do right now that will help you succeed in this environment.

- Focus on the experience. It’s going to be harder than ever to get higher spending couples, but if you focus on what experience they will have by doing business with you, I believe you will stand out. A great way to do this is to map out, draw out, whiteboard, etc. every step in the end to end process of working with a couple. Is it a great experience? Ask others to review it. What can you improve? Remove? Add? Provide the best possible experience you can and you’ll surely standout over all the other competitors.

- Cut your costs by doing a review of what you provide. I bet that you are providing stuff that no one uses or cares about. This is costing you profit. Remove things from your offer, simplify it, streamline it, make it simple to understand and easy for you to execute at the lowest possible cost. This is also why no.1 above is important because it will help you identify what’s not providing the best experience.

- Spend time and money reaching them in the places they are looking for you. Focus on the top 2-4 places where couples find products and services for their wedding. This is the 2017 list of sources used by couples and the percent of couples that use them.

Internet search engine(s) |

74% |

Wedding/bridal website(s) |

69% |

Friend or Family recommendation |

60% |

Social network(s) |

58% |

Browsing/shopping local store(s) |

43% |

Wedding/bridal blog(s) |

32% |

Wedding/bridal magazine(s) |

31% |

Wedding/bridal show/event |

31% |

Television or radio |

4% |

Phone book, newspaper, or postal mail |

4% |

As always, I’m here to help you succeed. If you have questions about these items, feel free to reach out.